The preferred way to get affordable auto insurance rates is to start doing a yearly price comparison from providers who provide car insurance in Mesa.

- Read and learn about how insurance works and the modifications you can make to lower rates. Many factors that cause high rates like your driving record and a substandard credit score can be remedied by making minor changes to your lifestyle. Keep reading for more ideas to help reduce prices and find additional discounts you may qualify for.

- Obtain price quotes from direct, independent, and exclusive agents. Direct and exclusive agents can provide rates from a single company like GEICO and State Farm, while independent agencies can quote prices for a wide range of insurance providers. View companies

- Compare the quotes to the price on your current policy and see if there is a cheaper rate in Mesa. If you find a better price and switch companies, ensure there is no coverage lapse between policies.

- Notify your company or agent to cancel your current auto insurance policy and submit any necessary down payment along with the completed application for the new coverage. Once received, store the proof of insurance certificate along with the vehicle’s registration papers.

The most important part of shopping around is to use similar coverage information on each price quote and and to get quotes from as many different insurance providers as possible. This enables a level playing field and a good representation of prices.

It’s an obvious assumption that insurance companies want to prevent you from shopping around. Insureds who do rate comparisons will, in all likelihood, move their business because there is a good probability of finding good coverage at a lower price. A recent study showed that people who routinely compared quotes saved over $70 a month compared to other drivers who never shopped around for better prices.

It’s an obvious assumption that insurance companies want to prevent you from shopping around. Insureds who do rate comparisons will, in all likelihood, move their business because there is a good probability of finding good coverage at a lower price. A recent study showed that people who routinely compared quotes saved over $70 a month compared to other drivers who never shopped around for better prices.

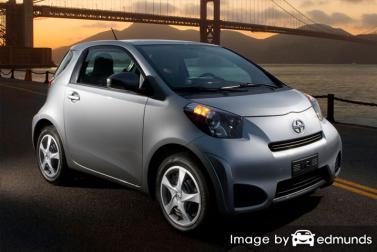

If finding the cheapest price for Scion iQ insurance is your objective, then having a grasp of how to get price quotes and compare insurance can save time, money, and frustration.

Pricing affordable insurance policy in Mesa is not that difficult. Essentially each driver who buys insurance most likely will get better rates. Although Arizona consumers must learn the way companies calculate your policy premium and apply this information to your search.

Most companies give prices for coverage directly from their websites. Getting online quotes for Scion iQ insurance in Mesa is fairly straightforward as you simply enter the amount of coverage you want into a form. After you complete the form, their system will obtain your driving and credit reports and returns a price based on these and other factors.

This helps simplify price comparisons, and it’s very important to perform this step in order to find affordable rates.

If you want to compare rates using this form now, check out the insurance providers below. If you have your current policy handy, we recommend you complete the form with the coverages exactly as shown on your declarations page. This guarantees you will have a price comparison based on identical coverages.

The following companies provide price comparisons in Mesa, AZ. If you wish to find cheap car insurance in AZ, we recommend you get rate quotes from several of them in order to get a fair rate comparison.

The Scion iQ Insurance Price Equation

Many things are part of the equation when premium rates are determined. Some of the criteria are obvious such as your driving record, but other criteria are not as apparent like where you live or your commute time.

Your age impacts your premiums – Older people are shown to be more cautious, tend to cause fewer accidents, and usually have better credit. Teenage drivers have a tendency to be less responsible when driving with friends therefore auto insurance rates are much higher.

Lower miles equals lower premium – Driving more miles annually the more it will cost to insure it. Most companies calculate prices based on their usage. Cars and trucks that sit idle most of the time can be on a lower rate level than vehicles that are driven to work every day. Improper usage on your iQ may be costing you higher rates. It’s a good idea to make sure your auto insurance coverage correctly shows the correct usage.

Physical damage deductibles – The deductibles are how much you are required to spend out-of-pocket if a claim is determined to be covered. Insurance for physical damage to your car, also called ‘full coverage’, covers damage that occurs to your car. Some coverage claims could be rear-ending another vehicle, fire damage, and damage caused by road hazards. The more damage repair cost you are required to pay out-of-pocket, the better rate you will receive.

Policy lapses lead to higher prices – Not maintaining insurance is not a good idea and auto insurance companies will penalize you for letting your coverage cancel without a new policy in place. Not only will you pay higher rates, not being able to provide proof of insurance could earn you a steep fine or even jail time.

Where you live – Having an address in areas with lower population is a positive aspect when trying to find low car insurance rates. People in densely populated areas regularly have much more traffic and longer commutes to work. Fewer drivers means less chance of accidents in addition to lower liability claims.

Only buy incidental coverages you need – Insurance policies have a lot of additional extra coverages that can add up on your iQ policy. Insurance for things like rental car coverage, high-cost glass coverage, and additional equipment coverage may be wasting your money. These may sound like a good investment when buying your policy, but if they’re wasting money remove them from your policy.

Scion iQ insurance loss statistics – Insurance companies use past loss statistics for each vehicle when setting rates for each model. Vehicles that tend to have higher claim amounts or frequency will cost more for coverage.

The data below shows the compiled insurance loss statistics for Scion iQ vehicles. For each policy coverage, the loss probability for all vehicles, regardless of make or model, is set at 100. Numbers below 100 indicate a favorable loss history, while values that are above 100 indicate a higher chance of having a claim or a tendency for claims to be larger.

| Specific Scion Model | Collision | Property Damage | Comp | Personal Injury | Medical Payment | Bodily Injury |

|---|---|---|---|---|---|---|

| Scion iQ | 77 | 81 | 75 |

Empty fields indicate not enough data collected

Statistics Source: Insurance Institute for Highway Safety for 2013-2015 Model Years

Three good reasons to insure your Scion vehicle

Even though it’s not necessarily cheap to insure a Scion in Mesa, auto insurance is required in Arizona but also provides important benefits.

- Just about all states have minimum liability requirements which means it is punishable by state law to not carry a specific level of liability protection if you want to drive legally. In Arizona these limits are 15/30/10 which means you must have $15,000 of bodily injury coverage per person, $30,000 of bodily injury coverage per accident, and $10,000 of property damage coverage.

- If you have a loan on your iQ, most banks will stipulate that you have insurance to ensure they get paid if you total the vehicle. If you do not keep the policy in force, the bank may buy a policy for your Scion at a much higher rate and require you to reimburse them for it.

- Insurance safeguards both your assets and your Scion iQ. Insurance will pay for all forms of medical expenses for both you and anyone you injure as the result of an accident. Liability insurance will also pay attorney fees if you are named as a defendant in an auto accident. If damage is caused by hail or an accident, comprehensive and collision coverage will pay to have it repaired.

The benefits of carrying adequate insurance more than offset the price you pay, especially if you ever need it. On average, a vehicle owner in Mesa overpays more than $855 a year so it’s important to compare rates once a year at a minimum to make sure the price is not too high.